Subscribe to our Newsletter!

Get our latest news straight into your inbox

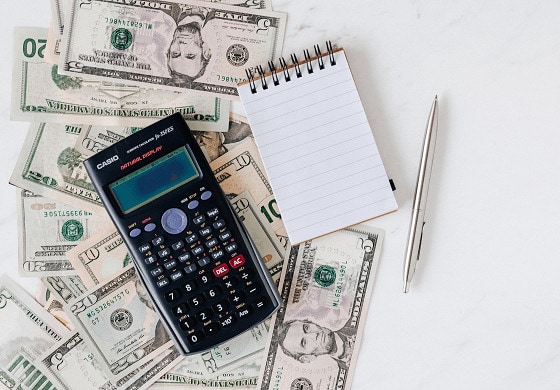

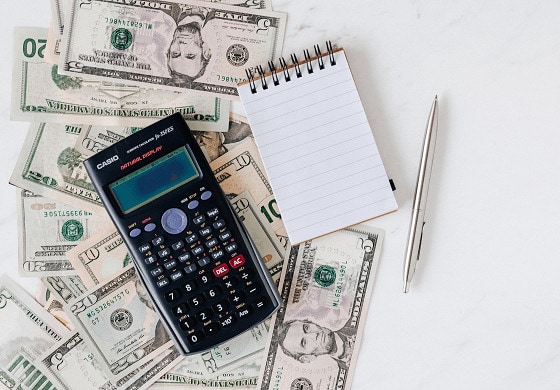

Stated Income Loans During Covid-19

With the Covid-19 pandemic raging across the country, the words ‘applying for a loan’ possess an especially ominous ring. Stated income loans carry a particular significance, considering the level of unemployment, stymied job sectors, and endangered forms of industry impacting the American markets.

Courtesy of the Dodd-Frank Act passed in 2010, the traditional concept of the stated income loan lay dead in the water, only ten years later being partially resurrected according to a specific set of principles. Enter the bank statement loan – the two most eligible categories focusing on the self-employed borrower and the loan qualifications for investors specializing in real estate.

Self-employed borrowers consult with termed non-qualifying mortgage lenders to obtain their bank statement loans. This can prove especially helpful to said borrowers existing within the real estate investment circuit, specifically if the individual seeks a position akin to house flipping or running a rental establishment. The qualifications required for such a loan remain the same for every applicant, i.e. an analysis of the individual’s net income, coupled with determination of their meeting a two-year minimum consistency of income, along with credit scores, down payments, and titled debt-to-income ratio.

Considering the effects of Covid-19 on the economy and the housing markets, it’s likely the partially reemerged presence of the income loan will become increasingly competitive as time goes on. Considering the rising rate of homelessness due to standard financial modeling no longer working, it’s likely that more and more potential for alternative solutions will need to progress.

Share This

Subscribe To Our Newsletter

Stay informed with our latest news delivered directly to your inbox.

Leave a Review